How to Get a Car Loan sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Securing a car loan can be a crucial step towards owning your dream vehicle, but the process can be daunting. From understanding the nuances of different loan types to managing your payments effectively, this guide will walk you through everything you need to know about getting a car loan.

Understanding Car Loans: How To Get A Car Loan

When it comes to purchasing a car, many people turn to car loans as a way to finance the purchase. A car loan is a type of financial product that allows individuals to borrow money from a lender to buy a vehicle. The borrower then agrees to repay the loan amount, plus interest, over a set period of time.

Types of Car Loans

There are different types of car loans available to suit various financial situations:

- Traditional Auto Loans: These are standard loans offered by banks, credit unions, or online lenders where you borrow a set amount and make monthly payments until the loan is paid off.

- Lease Buyout Loans: If you decide to purchase the vehicle you were leasing, you can take out a lease buyout loan to cover the remaining cost of the car.

- Bad Credit Car Loans: These loans are designed for individuals with poor credit scores and typically come with higher interest rates to offset the risk to the lender.

Importance of Credit Scores

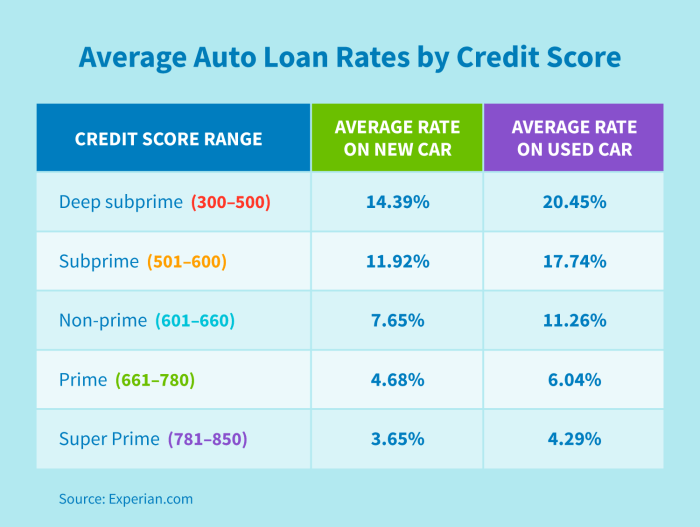

Your credit score plays a crucial role when applying for a car loan. Lenders use your credit score to determine your creditworthiness and the interest rate you will be offered. A higher credit score usually results in a lower interest rate, saving you money over the life of the loan. On the other hand, a lower credit score may lead to higher interest rates or even denial of the loan application.

Factors to Consider Before Applying

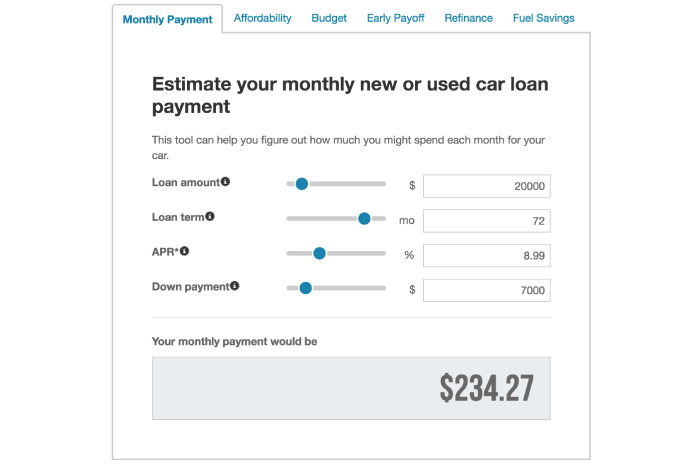

When applying for a car loan, there are several key factors to consider that can impact your overall borrowing experience. Lenders take into account various aspects of your financial profile when approving car loans, determining interest rates, and deciding on loan term lengths.Interest rates play a significant role in the total cost of a car loan. A higher interest rate means you will pay more over the life of the loan, increasing the overall cost of the vehicle.

It’s essential to shop around for the best interest rates available to ensure you are getting the most favorable terms for your loan.

Loan Approval Factors

- Your credit score: Lenders consider your credit score as a measure of your creditworthiness. A higher credit score typically results in better loan terms, including lower interest rates.

- Income and employment history: Lenders may ask for proof of income to ensure you have the financial means to repay the loan. A stable employment history can also work in your favor.

- Debt-to-income ratio: Lenders assess your debt-to-income ratio to determine if you can afford the monthly payments on the loan in addition to your other financial obligations.

Loan Term Lengths

- Short-term loans: Typically range from 24 to 36 months. While monthly payments may be higher, you’ll pay less in interest over the life of the loan.

- Medium-term loans: Often span 48 to 60 months. Monthly payments are more manageable, but you may end up paying more in interest compared to shorter loan terms.

- Long-term loans: Extend beyond 60 months, sometimes up to 84 months. Monthly payments are lower, but you’ll pay more in interest and risk owing more than the car is worth.

Applying for a Car Loan

When applying for a car loan, there are several important factors to consider to increase your chances of approval and secure favorable terms.

Documents Needed for a Car Loan Application

- Proof of income: Lenders will require documents such as pay stubs, tax returns, or bank statements to verify your ability to repay the loan.

- Identification: A valid driver’s license, passport, or state ID is typically needed to confirm your identity.

- Proof of residence: Utility bills or lease agreements can serve as proof of your current address.

- Credit history: Be prepared to provide information on your credit history, including your credit score.

- Vehicle information: Details about the car you intend to purchase, such as the make, model, and VIN, may be required.

Tips to Improve Your Chances of Getting Approved

- Check your credit score: Review your credit report and work on improving your score before applying for a car loan.

- Shop around for lenders: Compare offers from different lenders to find the best terms and interest rates.

- Consider a co-signer: If your credit history is less than ideal, a co-signer with good credit may help you secure a loan.

- Offer a down payment: Making a larger down payment can reduce the amount you need to borrow and show lenders your commitment.

- Limit loan applications: Applying for multiple loans within a short period can negatively impact your credit score. Be strategic in your applications.

Process of Getting Pre-approved for a Car Loan

- Submit an application: Provide the necessary documents and information to the lender for review.

- Receive a decision: The lender will evaluate your application and creditworthiness to determine if you qualify for pre-approval.

- Get a pre-approval letter: If approved, you will receive a pre-approval letter outlining the loan amount and terms you qualify for.

- Start shopping: With a pre-approval in hand, you can confidently shop for a car within your budget knowing the financing is already in place.

Choosing the Right Loan

When it comes to choosing the right car loan, it’s essential to compare different lenders and their offerings to find the best deal for your financial situation.

Fixed vs. Variable Interest Rate

One crucial factor to consider when selecting a car loan is whether to opt for a fixed or variable interest rate. Here’s a breakdown of the key differences:

- Fixed Interest Rate: With a fixed interest rate, your monthly payments remain the same throughout the loan term. This provides stability and predictability, making it easier to budget for your car payments.

- Variable Interest Rate: A variable interest rate can fluctuate based on market conditions. While this type of loan may offer lower initial rates, there is a risk of increased payments if interest rates rise.

Reading the Terms and Conditions

Before signing any car loan agreement, it’s crucial to read and understand the terms and conditions thoroughly. Here’s why it’s important:

- Ensure you are aware of any fees, penalties, or charges associated with the loan.

- Understand the repayment schedule, including the total amount to be paid and the duration of the loan.

- Clarify any clauses related to early repayment or refinancing options.

Managing Your Car Loan

When it comes to managing your car loan, it’s crucial to stay on top of your payments and understand the consequences of missing or defaulting on them. Additionally, exploring options like refinancing can help you save money in the long run.

Making Timely Payments

Timely payments are essential to maintaining a good credit score and avoiding late fees. Setting up automatic payments or reminders can help you stay organized and ensure you never miss a payment.

Implications of Missing or Defaulting

- Missing a payment can result in late fees, increased interest rates, and a negative impact on your credit score.

- Defaulting on your car loan can lead to repossession of the vehicle, legal action, and further damage to your credit history.

Refinancing Your Car Loan, How to Get a Car Loan

If you find yourself struggling with high monthly payments or interest rates, refinancing your car loan could be a viable option. By refinancing at a lower interest rate or extending the loan term, you may be able to reduce your monthly payments and save money over time.

Final Review

In conclusion, obtaining a car loan involves careful consideration of various factors and responsible financial management. By following the advice Artikeld in this guide, you can navigate the process with confidence and secure a car loan that suits your needs.