Exploring the essential steps of creating a family budget within 30 minutes, this guide offers practical tips and insights to help you manage your finances effectively. Learn how to allocate resources wisely and secure your family’s financial future with ease.

Discover the simplicity of budgeting and the empowering impact it can have on your family’s financial well-being.

Importance of Budgeting for Families

Budgeting is a crucial aspect of maintaining financial stability for families. It helps in managing household expenses effectively, ensuring that income is allocated wisely to cover necessary costs and achieve financial goals.

Benefits of Having a Budget

- Control over Finances: A budget provides a clear overview of income and expenses, allowing families to track where their money is going.

- Saving for Emergencies: By budgeting, families can set aside funds for unexpected events like medical emergencies or car repairs, avoiding financial strain.

- Planning for Future Goals: Budgeting enables families to save for long-term goals such as buying a home, funding education, or retirement, ensuring financial security.

Quick Budgeting Techniques for Families

Creating a family budget quickly can seem daunting, but with the right techniques, it can be a simple and effective process. Here are step-by-step guidelines to help you create a family budget in just 30 minutes:

Step-by-Step Guide to Creating a Simple Family Budget

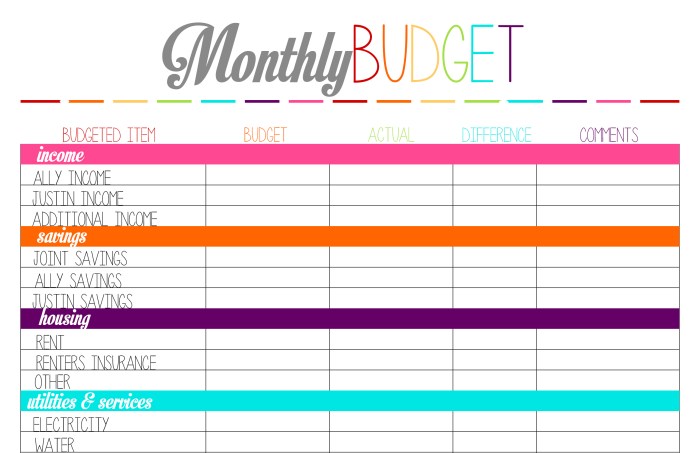

- List Your Income: Write down all sources of income for your family, including salaries, bonuses, and any other earnings.

- Track Your Expenses: Record all your monthly expenses, such as rent, utilities, groceries, and entertainment.

- Categorize Your Expenses: Divide your expenses into categories like fixed (mortgage, insurance) and variable (dining out, shopping).

- Set Financial Goals: Determine your short-term and long-term financial goals, such as saving for a vacation or college fund.

- Create a Budget: Allocate your income to cover your expenses and savings goals, making sure your expenses do not exceed your income.

Comparison of Different Budgeting Methods Suitable for Families

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Assign every dollar of your income a specific purpose, ensuring all income is used effectively.

- Envelope System: Allocate cash to specific envelopes for different spending categories to control expenses.

Tips on Tracking Expenses and Adjusting the Budget as Needed

- Use Budgeting Apps: Utilize apps like Mint or YNAB to track expenses automatically and analyze spending patterns.

- Review Regularly: Check your budget regularly to see if you are sticking to your plan and make adjustments as needed.

- Emergency Fund: Always prioritize building an emergency fund to cover unexpected expenses and avoid derailing your budget.

Involving the Family in Budgeting

Family involvement in budgeting is crucial for creating a sense of shared responsibility and financial awareness among all members. By including the family in budget planning, everyone gains a better understanding of the household’s financial situation and can work together towards common goals.

Discussing Financial Goals with Children and Teens

When talking to children and teens about financial goals, it’s important to use age-appropriate language and examples to help them grasp the concept. Start by discussing the difference between needs and wants, and explain how budgeting can help prioritize spending.

- Set achievable short-term goals like saving for a specific toy or outing to teach the value of budgeting.

- Involve teens in discussions about larger family expenses like vacations or home renovations to show them the impact of financial planning.

- Encourage children to contribute ideas for saving money or cutting expenses, fostering a sense of ownership in the budgeting process.

Making Budgeting a Collaborative and Educational Experience

Transform budgeting into a collaborative and educational experience by involving the whole family in decision-making and planning. This not only strengthens family bonds but also ensures that everyone is committed to the budgeting goals.

- Hold regular family budget meetings to review expenses, set new goals, and celebrate achievements together.

- Assign age-appropriate financial tasks to each family member, such as tracking expenses, researching discounts, or comparing prices for purchases.

- Create a visual representation of the budget, like a savings thermometer or chart, to make progress tangible and engaging for children and teens.

Conclusion

In conclusion, mastering the art of budgeting in just 30 minutes can pave the way for a secure and prosperous future for your family. By involving everyone in the process and staying committed to your financial goals, you can achieve long-term stability and peace of mind.