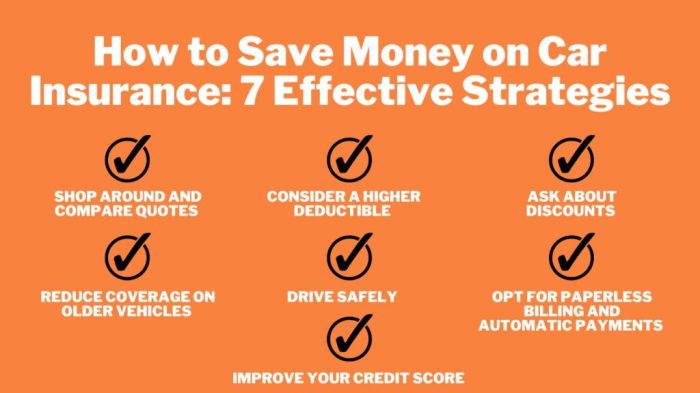

How to Save Money on Car Insurance starts by exploring various strategies to reduce your insurance costs, from comparing providers and adjusting policies to improving driving habits and selecting the right vehicle.

As we delve deeper into each aspect, you’ll uncover valuable insights that can help you make informed decisions and save money on your car insurance.

Research and Comparison

When it comes to saving money on car insurance, one of the most crucial steps is to research and compare different insurance providers and their coverage options. By doing so, you can find the best policy that suits your needs while also saving you money in the long run.Identify discounts offered by various insurance companies. Many insurers offer discounts for various reasons, such as having a clean driving record, bundling multiple policies, or having safety features installed in your vehicle.

Taking advantage of these discounts can significantly reduce your insurance costs.Discuss the importance of researching multiple quotes before making a decision. It’s essential to obtain quotes from several insurance companies to compare prices and coverage options. By doing this, you can ensure that you are getting the best deal possible and not overspending on your car insurance.

Driving Habits and Behavior

Safe driving habits play a crucial role in determining your car insurance premiums. Insurance companies reward responsible drivers with lower rates, while risky behaviors can lead to increased costs. Maintaining a clean driving record is essential to save money on car insurance.

Impact of Traffic Violations and Accidents

- Traffic Violations: Speeding tickets, reckless driving charges, and other traffic violations can significantly raise your insurance rates. Insurance companies view these behaviors as indicators of higher risk, leading to increased premiums.

- Accidents: Being involved in accidents, especially those deemed at-fault, can cause a spike in your insurance costs. Insurance companies consider accident history when calculating premiums, as past incidents suggest a higher likelihood of future claims.

Tips to Maintain a Clean Driving Record

- Follow Traffic Laws: Obeying speed limits, traffic signals, and other rules of the road can help you avoid tickets and accidents, keeping your driving record clean.

- Defensive Driving: Stay alert, anticipate potential hazards, and practice defensive driving techniques to reduce the risk of accidents.

- Avoid Distractions: Texting, talking on the phone, or engaging in other distractions while driving can impair your judgment and increase the likelihood of accidents. Stay focused on the road at all times.

- Regular Maintenance: Ensure your vehicle is properly maintained to prevent breakdowns or malfunctions that could lead to accidents.

Vehicle Selection and Features

When it comes to saving money on car insurance, the type of vehicle you choose can have a significant impact on your premiums. Insurance companies consider various factors related to your car when determining the cost of coverage.

Role of Vehicle Type in Insurance Costs

- Insurance companies typically charge higher premiums for sports cars and luxury vehicles due to the higher cost of repairs and increased likelihood of theft or accidents.

- On the other hand, choosing a reliable and safe vehicle with good safety ratings can help lower insurance costs.

- Older cars with lower market value may also result in lower premiums since the cost of repairs or replacement is generally lower.

Importance of Safety Features

- Vehicles equipped with safety features such as airbags, anti-lock brakes, and electronic stability control can reduce the risk of injury in an accident, leading to lower insurance premiums.

- Insurance companies often offer discounts for cars with advanced safety features that minimize the likelihood of accidents or injuries.

- Installing anti-theft devices like alarms or tracking systems can also lower insurance costs by reducing the risk of theft.

Choosing a Cost-Effective Car

- Before purchasing a vehicle, research insurance costs for different makes and models to identify cars that are more affordable to insure.

- Consider factors such as the car’s safety ratings, repair costs, and theft rates when selecting a cost-effective vehicle.

- Opting for a car with a good track record for reliability and safety can help you save money on insurance premiums in the long run.

Policy Adjustments and Deductibles: How To Save Money On Car Insurance

When it comes to saving money on car insurance, making strategic policy adjustments and understanding deductibles can make a significant impact on your overall costs. By tweaking your coverage limits and deductibles, you can potentially lower your insurance premiums without sacrificing necessary protection.

Deductibles and Insurance Premiums

Adjusting your deductibles can directly impact the cost of your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Typically, a higher deductible means lower premiums, while a lower deductible results in higher premiums. Consider your financial situation and driving habits when deciding on a deductible amount.

Benefits of Adjusting Coverage Limits

By adjusting your coverage limits, you can customize your policy to better suit your needs and potentially save money. For example, if you have an older vehicle, you may opt for lower comprehensive and collision coverage limits to reduce your premiums. Evaluate your coverage needs and adjust accordingly to find the right balance between protection and cost.

Tips for Lowering Insurance Costs, How to Save Money on Car Insurance

One effective way to save on car insurance is by bundling policies. Many insurance companies offer discounts for bundling auto insurance with other policies such as homeowners or renters insurance. Additionally, consider adjusting your deductibles – increasing them can lower your premiums, but make sure you can afford the out-of-pocket costs in case of an accident.

Ending Remarks

By implementing the tips and tricks discussed, you can effectively lower your car insurance expenses while ensuring you have adequate coverage. Remember, a proactive approach to managing your policy can lead to significant savings in the long run.